By Andy Larsen | The Salt Lake Tribune | Photo by Rick Egan | The Salt Lake Tribune

Lica Strasner is retired with a fixed income from Social Security.

So, to make her money stretch, the Midvale woman plans meals involving rice, pasta and beans in bulk, then freezes them later. (Peppers and onions freeze and thaw surprisingly well, she says.)

Still, she says, “The last days of the month are often bleak — empty freezer and refrigerator, empty pantry shelves.”

It isn’t easy out there for a lot of Utahns.

Costs are increasing. Food bank demand within the state is higher than ever, with many families feeling the pinch. Meanwhile, population growth for Utah is decreasing and leading economists feel that affordability, especially with regards to housing, is a key reason why.

We wanted to know how you were doing.

Through the Utah News Collaborative, we asked readers across the state to tell us about their lives — and how people are coping with the increased costs.

Indeed, while consumer sentiment is falling, Utah was just ranked as the U.S.’s No. 1 economic state for the third year running, as state leaders are eager to tell you.

However, even if Utah is faring better than its competition, that doesn’t change the reality for those who are struggling. We wanted to understand the sacrifices those people are making to subsist in this economy.

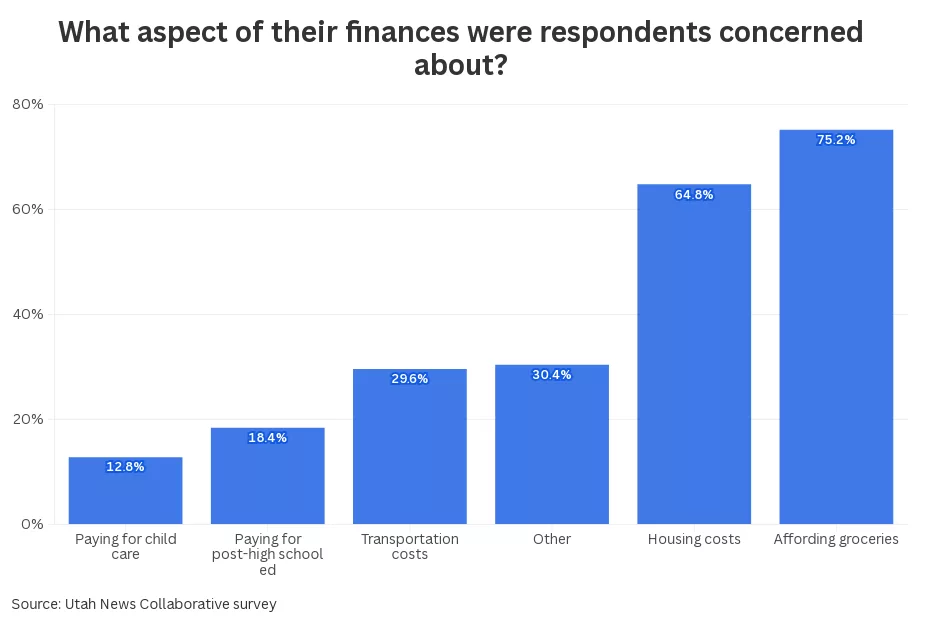

First, we asked about people’s top financial concerns. Among housing costs, affording groceries, paying for child care, transportation costs, paying for college or post-college education, which were most top of mind for our respondents? We allowed people to choose multiple answers, or suggest their own.

Most important to our respondents was simply affording groceries. More than 75% of respondents expressed that concern.

Food prices have risen, depending on the good tracked, between 16% and 35% in Utah over the last five years. Of course, affording groceries is the most basic of necessities anyway — high costs in any other area will make Utahns care about affording groceries as well.

Housing costs were the second largest concern. About 65% of respondents said they were concerned about paying their rent or mortgage. About 13% of respondents had made changes to their housing situation as a result of the economy — this involved moving, being unable to move, or sharing housing with others.

Spencer Kohler, from Parowan, indicated that he’d like to be able to move from the rural town in Iron County, as he has to commute more than two hours per day to a job he believes will provide for his household. As a result, he misses out on significant family time.

“There are a lot of people who do this,” Kohler said. “It’s not right and things need to change.”

Besides the multiple-choice question above, we also asked people to answer how they were dealing with rising costs in a free-form response box. Of those respondents, 60% said they were cutting non-essential costs to save money — things like eating out, travel, or sports leagues for their kids.

A further 31% said that they had either switched jobs or taken on multiple jobs as a result of the changing economy.

All of that makes sense. What really concerned me were some of the lengths people were going to in order to make ends meet, though. From the free responses, I created a new category of responses called “people doing things that would make financial advisors cringe.”

In general, those professionals are supportive of raising income or cutting costs. They’re not supportive of, for example, pulling from funds saved for retirement in order to pay for groceries, or maxing out multiple credit cards. 15% of respondents said they were doing something that fit in those categories, which scares me.

“I work three jobs and still have to use credit cards to feed my kids,” Makayla Shank, from Millard County, reported.

It gets worse. A worrying number of respondents reported behavior I felt was something a doctor or psychologist would be concerned about. Getting ill from overwork, or eating less or differently than is healthy. Some folks reported skipping doctor appointments, or taking prescriptions less than indicated to save money. In all, that category reflected 13% of respondents.

To be sure, not every Utahn is facing consequences this dire. However, some of them are. I believe it is important to take them into consideration as we consider economic policy.

We’ll have more reporting in the weeks and months to come, especially as new tariffs and economic stability concerns hit Utah and the nation.

This article is published through the Utah News Collaborative, a partnership of news organizations in Utah that aims to inform readers across the state.